PRETEND AND EXTEND:

ONE BUILDER, SIX BROKEN BANKS

James Bovino is a bank

killer.

His companies defaulted

on more than $300 million in loans and contributed to the failure of six banks

across the country during the Great Recession — including three in Southwest

Florida.

The son of a janitor,

Bovino rose to become chairman of his own bank and a prominent New Jersey

developer with two dozen multimillion-dollar projects under his belt.

Business associates say

he prided himself on being a family man. He once told The New York Times that

he watched only G-rated movies and had fired people for swearing in the

workplace.

But his squeaky-clean

exterior did not stop him from using strong-arm tactics — hiring a disbarred

attorney with ties to organized crime — to get what he wanted in the combative

world of New Jersey development. When the economy slid into recession, former

associates say Bovino diverted bank funds meant to pay subcontractors, and

regulatory documents and a government lawsuit show he participated in

"improper" deals that broke bank policies, hiding the fact that he

was no longer current on his loans.

Bovino, 71, is not

accused of any crimes.

The developer did not

return three calls left on his answering machine or a handwritten message left

in the mailbox outside his house — red brick with white columns — in Ho-Ho-Kus,

N.J.

Builder James Bovino started his career as a school teacher and rose to become a builder with projects across the country. He now lives in this home in Ho-Ho-Kus, N.J.

Builder James Bovino started his career as a school teacher and rose to become a builder with projects across the country. He now lives in this home in Ho-Ho-Kus, N.J.

Staff Photo / Michael Braga

Bovino's rise and fall

provide a glimpse into how developers and bankers walked hand-in-hand during

the real estate boom, and how they stopped playing by the rules even before the

crisis hit.

In the end, developers

like Bovino not only contributed to the failure of 69 banks in Florida and

hundreds more across the country — their actions hurt ordinary workers and

small businesses.

In Bovino's case, at least

120 building contractors and subcontractors say they were left with more than

$13 million in unpaid bills, court records from six states show.

"Getting to the

end in 2008, there is collusion between bankers and their customers," said

Dick Newsom, who served as a regulator with the Federal Deposit Insurance Corp.

for 17 years. "Borrowers knew banks were desperate to hide bad loans, and

banks understood that developers would lie, cheat and steal — and do whatever

they had to — to survive."

The Herald-Tribune

began investigating Bovino and his businesses during its yearlong inquiry into

failed Florida banks.

Regulatory documents,

bankruptcy records, civil filings and interviews with 15 people show that

lenders ignored warning signs and funneled money to his companies even after

the recession took hold.

Among the findings:

• Bradenton's Freedom

Bank did not look at Bovino's total debts before lending one of his companies

$7.5 million in March 2007.

• Sarasota's Century

Bank lent another Bovino company $900,000 in 2008 to cover unpaid interest and

bounced checks.

• Cape Fear Bank in

North Carolina broke laws and regulations when it provided a third Bovino

company with $2.7 million in May 2008.

• Englewood's Peninsula

Bank signed off on a $12.1 million loan to another Bovino company as the world

economy was melting down in October 2008. The purpose of this loan, according

to regulatory reports, was to help Peninsula get 200 acres of repossessed land

off its books. Regulators called it an "improper sale," and analysts

say the deal was meant to trick regulators into thinking the bank's capital

stockpiles were deeper than they actually were.

But Bovino's story does

not end with failed banks and unpaid loans. For the past two years, he has been

scrambling to rebuild his real estate empire by repurchasing foreclosed

properties at a discount.

In North Carolina, a

company controlled by one of Bovino's associates bought 121 lots in a large

housing project outside Wilmington. In Florida, a company managed by another associate

bought two unfinished town homes and 11 vacant lots in Bradenton's Palma Sola

neighborhood.

Shay Hawkinberry, a

Sarasota real estate agent and interior decorator, said Bovino raised $1.1

million from a New York City investment firm to buy town homes in Florida and

start fixing them up. But she said Bovino diverted some of the money to one of

his projects in New Jersey.

Though Bovino's

investors say he had permission to use the money as he saw fit, Hawkinberry

said the diversion meant Bovino did not have enough left to pay nearly $40,000

to her and a flooring contractor.

"He told me to

find a bank that would lend him money, because that would be the only way I

would get paid," Hawkinberry said.

She introduced a Bovino

associate to three local lenders, and each turned him down.

"I did everything

I could," one of the mortgage brokers wrote in an email to Hawkinberry.

"But when you have partial tax returns, bank statements missing pages, no

idea what mortgages go to what property, it is really hard to get a loan

approved."

From the bottom up

Before he became a

multimillionaire, Bovino was a schoolteacher.

He began dabbling in

real estate in the 1970s, buying and building homes and apartments in his spare

time.

By the 1980s, he had

become a full-time developer, accumulating at least 11 apartment buildings and

three office structures in northern New Jersey by the decade's end.

James Bovnio built this office building in Woodcliff Lake, N.J., to serve as his company headquarters until late 2008.

James Bovnio built this office building in Woodcliff Lake, N.J., to serve as his company headquarters until late 2008.

Staff Photo / Michael Braga

Friends and business

associates say Bovino fought to overcome polio as a child, which stunted his

growth. But what he lacked in height, he made up for in tenacity.

Bovino also had a gift

for relating to people at every level. That helped him on worksites, where he

interacted easily with construction workers, and in planning board meetings,

where he was able to charm public officials and concerned citizens.

It also helped when it

came to raising money from bankers and winning favor from politicians. In 1991,

New Jersey Gov. Jim Florio appointed him to the state's Bank Advisory Board.

But there was another

side to Bovino.

Creditors say he was

slow to pay his bills. In one well-publicized instance, he reneged on paying a

multimillion-dollar commission to Dennis Sammarone, the former chef for hotel

heiress Leona Helmsley.

Bovino was trying to

buy a vacant 16-acre tract in New Jersey near the George Washington Bridge that

was owned by the Helmsley family. But Helmsley, dubbed the "Queen of

Mean" by the press, would not return his phone calls. So he asked

Sammarone to intervene and the chef opened the door for Bovino to complete a

$46.3 million purchase in 2003.

When Sammarone did not

get the commission he was promised, he sued Bovino and eventually won a $13.9

million judgment.

Robert Cohen, who won a

$2.3 million judgment after Bovino did not fully pay for the purchase of a New

York stock trading firm, said Bovino had a motto: "Don't pay anyone until

they ask you three times."

"He was supposed

to give me $1.5 million upfront, but I don't believe he gave me half that

amount, and I had to twist his arm for the rest," Cohen said. "After

I won my suit, I talked to him about a settlement. He'd say a number. I'd say

OK. Then I'd never see the money."

One of Bovino's former

Florida executives, who asked to remain anonymous, was more succinct:

"If Jimmy owed you

$1,000, he'd tell you he'd pay you. But that might be in 10 years from now —

and that was OK with him."

Calling on Rigolosi

Newspaper reports and

lawsuits show that Bovino also had a tough side that he displayed when

competing developers threatened his turf, or when reluctant lawyers, planning

commissioners, judges and politicians needed persuading.

Robert Fraser stood to

make a large commission from the sale of land to a young developer who was

trying to build a New Jersey apartment complex in 1989. But when Bovino blocked

that purchase, Fraser sued.

He accused Bovino of

hiring an attorney to tie up planning board meetings and slow the developer's

efforts to secure approvals.

When that did not work,

Fraser said Bovino offered the developer $200,000 to abandon the project.

Unsuccessful once

again, Bovino turned to Vincent Rigolosi, a disbarred attorney with ties to the

powerful Genovese crime family.

Rigolosi was indicted

in 1981 and accused of helping Mafia crime boss "Cockeye Phil"

Lombardo bribe a police officer who was Maced outside a Jersey Shore restaurant

by Lombardo's son.

A jury later found

Rigolosi not guilty, but the New Jersey Bar Association stripped him of his law

license five years later. An opinion letter drafted by the the state Supreme

Court said that Rigolosi "actively participated in a criminal

conspiracy," and that his "conduct reveals a flaw running so deep

that he can never again be permitted to practice law."

Despite Rigolosi's

well-publicized history, Bovino repeatedly asked the ex-lawyer to help him work

out intractable problems over the years. Rigolosi — a former mayor of Garfield,

N.J., and Democratic Party chairman for Bergen County — had useful connections.

Indeed he was so

powerful, Fraser said, that he persuaded Fraser's first attorney to quit.

"Rigolosi calls my

attorney and tells him this is a B.S. lawsuit," Fraser said. "He

said: 'These young kids don't know what they're doing' and my attorney got

scared off. He tried to tell me to drop the case."

Fraser hired a new

attorney, who was also approached by Rigolosi. But this time, the lawyer kept

fighting for six and a half years.

The case was finally

dismissed when the state Supreme Court ruled that Bovino, who owned a parcel

adjacent to Fraser's, had reason to try to block the development.

A decade later, The

Record of Hackensack reported that Rigolosi was still working for Bovino. A

prominent fundraiser for Sen. Frank Lautenberg, Rigolosi convinced the senator

to visit Bovino's $1 billion development near the George Washington Bridge in

late 2007, the newspaper said.

But even Lautenberg,

who is now deceased, could not help that failed project get off the ground.

Coast to coast

Bovino was luckier

after the savings and loan crisis of the late 1980s and early 1990s.

He survived with his

New Jersey real estate holdings largely intact, and by 1998 was ready to expand

across the country.

His first stop was

Wilmington, N.C., where he began developing housing projects in and around the

coastal city. Then it was on to Arizona and Florida in the early 2000s and

Georgia and New York by the middle of the decade.

At the peak, Bovino's

companies were building homes in the suburbs of Phoenix and Atlanta, apartments

in Raleigh, N.C., town homes in Palmetto and upscale condos in Port Chester,

N.Y.

James Bovino built this suburban housing development near Atlanta.

James Bovino built this suburban housing development near Atlanta.

Staff Photo / Michael Braga

Bovino also launched

Citizens Community Bank in Ridgewood, N.J., in November 2004. One of his

companies purchased an institutional trading firm the following year that

bought and sold stocks and bonds on the New York Stock Exchange, and he laid

out plans for building a 47-story skyscraper overlooking the Hudson River in

Fort Lee, N.J.

"Jimmy's biggest

downfall was that he had an opportunity to expand quickly — so he did,"

said Greg Cagle, a Georgia developer who helped Bovino buy a housing

development in the Atlanta suburbs. "He expanded too quickly and ended up

being spread too thin."

Smoke and mirrors

Bovino was always

meticulously dressed.

A former employee said

he would never wear a suit more than once before having it dry cleaned; his

shoes were regularly sent off for polishing at Saks Fifth Avenue in New York.

He maintained swanky

offices on Park Avenue, and even his flagship company's name — Whiteweld

Barrister & Brown — was meant to project an air of Old-World affluence.

But the names were all

made up.

A former employee said

Bovino chose Whiteweld because his father worked as a janitor for White Weld

& Co., a prestigious Boston-based global financial firm that can trace its

history back to the 1630s. The other two names were tacked on because they

sounded good together, the former employee said.

To further add to his

cachet, Bovino started a charity called The Whiteweld Foundation to benefit

children. It put on half-dozen concerts at Lincoln Center and Carnegie Hall

during the real estate boom with headliners that included Gladys Knight, Chuck

Mangione, Burt Bacharach and the Count Basie Orchestra.

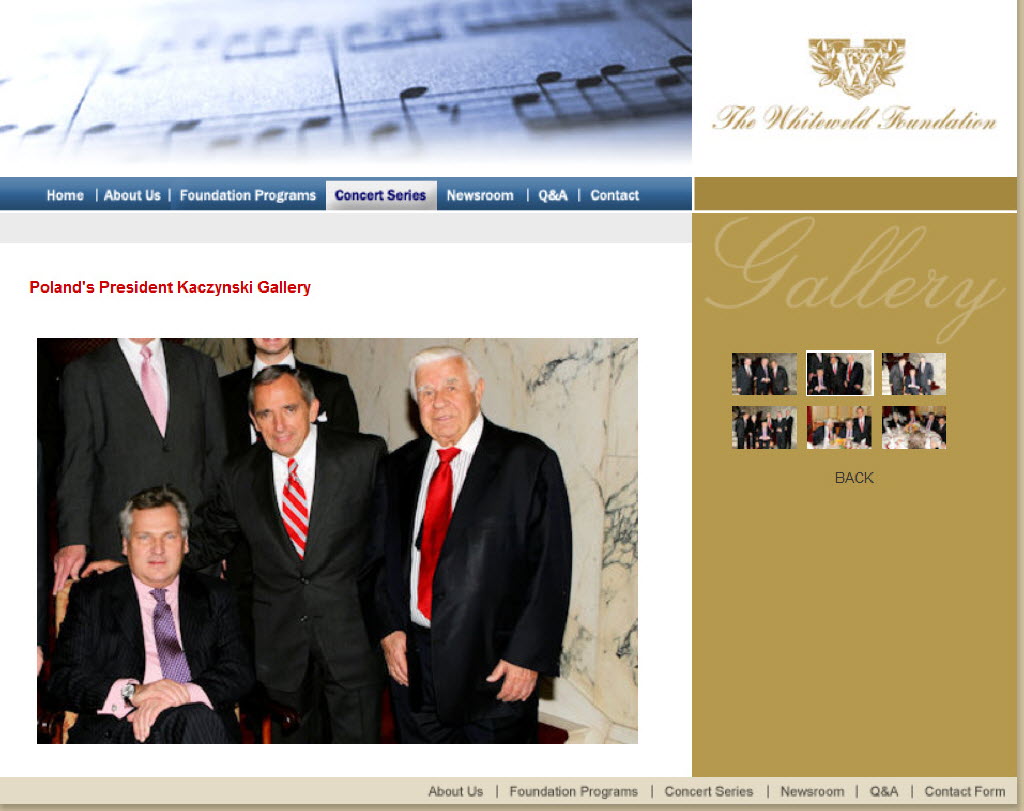

James Bovino, center, established The Whiteweld Foundation and often threw charity galas at Carnegie Hall and Lincoln Center in Manhattan. Bovino is seen on the foundation’s Web site with Polish President Lech Kaczynski.

James Bovino, center, established The Whiteweld Foundation and often threw charity galas at Carnegie Hall and Lincoln Center in Manhattan. Bovino is seen on the foundation’s Web site with Polish President Lech Kaczynski.

whiteweldfoundation.org

"It was all smoke

and mirrors, really," said Cohen, who sued Bovino after the New Jersey

developer failed to pay him fully for his New York investment firm. "The

guy was leveraged out the wazoo."

But bankers were

impressed by Bovino, and he had few problems borrowing when the economy was

strong.

In Georgia and North

Carolina, Regions Bank became one his major backers. In Florida, Bank of

America lent him more than $7 million to build town homes in Palmetto.

By 2006, however, big

banks were reluctant to keep fueling Bovino's insatiable demand for money.

Community banks stepped

into the void.

A former Century Bank

executive, who asked not to be named because of a new job she has secured, said

Century president John O'Neil was seduced by the fact that Bovino was the

chairman of his own New Jersey bank and had served on a state bank advisory

committee. O'Neil greenlit approvals for one of Bovino's companies to borrow $9

million in October 2006 to buy 274 acres in Manatee County.

"When the

president says, 'We're going to do business with this guy,' you don't look for

stuff that says we can't do this," the former Century executive said.

She said Century was

trying to increase its loan portfolio and ensure bonuses for top executives at

the time. "People do stupid things to meet their goals," she said.

O'Neil did not return

a call and an email message to his Fort Lauderdale attorney.

Bankers at nearby

Peninsula Bank and Freedom Bank were equally eager to meet Bovino's financial

needs.

Peninsula lent one of

his companies $2 million in May 2007 to develop town houses on the Hillsborough

River, while Freedom failed to properly analyze Bovino's finances when it

allowed one of his companies to borrow $7.5 million to pay off an existing

loan.

A former Freedom loan

officer, who also asked not to be mentioned by name because he is still

employed in the banking industry, said executives did not try to count up

Bovino's outstanding debts across the country before lending him money. They

merely ordered an appraisal and evaluated the loan based on what they felt the

collateral was worth.

Banking experts and

former regulators say that was a big mistake.

The FDIC warned banks a

year earlier to cut back on making speculative real estate loans to developers.

Regulators also made it clear that bankers needed to complete a global

financial analysis of a borrowers debts before extending money.

"With developers,

you have to do a really good job of identifying contingent liabilities,"

said Newsom, the former FDIC regulator. "Nearly every greedy banker looks

only at the project and ignores the other debts a developer might have."

'... regret what you

said'

A few months after

receiving loans from Freedom and Peninsula, Bovino's operations ran into

trouble across the country.

Speculator-driven

demand for housing in Arizona, Georgia and Florida started sliding in late 2006

and prices plummeted the following year.

One of Bovino's former

managers in Georgia said Bovino's development began losing money in 2007

because of high construction costs in the mountainous terrain outside Atlanta.

In Manatee County, one

of Bovino's companies was having so much trouble selling town homes at Oak

Trail that he had to take out personal loans and buy six of the units himself

to pay down some of what his company owed to Bank of America, court records

show.

James Bovino sold four units in a Palmetto subdivision to his employees and another six units to himself after he couldn’t find other buyers.

James Bovino sold four units in a Palmetto subdivision to his employees and another six units to himself after he couldn’t find other buyers.

Staff Photo / Michael Braga

In New Jersey, he was

facing the lawsuit from Leona Helmsley's former chef and the Environmental

Protection Agency fined one of his companies $600,000 for failing to get

permits before installing a sewer system at one of his developments, court

records show.

About the same time,

The Record ran a front-page story in December 2007, about how Bovino's $1

billion development by the George Washington Bridge was dead in the water.

That was the time for

banks all across the country to stop funding Bovino, financial experts say. But

only a few adopted that approach.

A Regions Bank loan

officer cut off Bovino's funding in both Georgia and North Carolina in early

2008 after he refused to use collateral from one of his North Carolina projects

to shore up more than $6 million in Georgia loans.

"He stopped

funding our North Carolina project ... because we wouldn't agree with his cross

collateralizing," Bovino said in a deposition after Regions filed to

foreclose. "I told him: 'You'll never see that. And he said: 'You'll

regret what you said.'"

Under a

cease-and-desist order from state and federal regulators, Freedom Bank also

acted swiftly to foreclose on Bovino in May 2008.

But Cape Fear Bank

provided one of Bovino's companies with $2.7 million that same month to help it

pay back taxes and cover future interest payments.

That loan later went

into default and was mentioned as one that helped bring down the North Carolina

bank when the FDIC sued Cape Fear's officers and directors in April 2012.

"No credit history

was located in the file," the FDIC wrote in its suit. "Additional

deficiencies and violations identified on this loan include the failure to

adhere to applicable laws and regulations."

Century Bank executives

were equally negligent, according to a similar lawsuit filed by the FDIC.

Regulatory reports show

that one of Bovino's companies owed the bank $280,000 in back interest payments

in late 2007. But Century kept handing him more money.

The bank first lent the

company enough to cover unpaid interest in March 2008. Then in September, it

lent Bovino's company another $641,000 after the company sent the bank a string

of bounced and uncashed checks.

"That's called

'pretend and extend,' " said Irv DeGraw, a banking and finance professor

at St. Petersburg College. "The bank was playing a little game of

make-believe in the hope that the market would turn and everything would be

OK."

Peninsula Bank took

that game to a higher level.

One of Bovino's

companies defaulted on a $2 million loan from the bank in early 2008. But

instead of foreclosing, Peninsula worked out a deal in which it would renew the

loan as long as one of Bovino's companies took 200 acres in St. Lucie County

off the bank's hands.

Peninsula had

foreclosed on the former owner and did not want to take a loss. So it

transferred the land to Bovino's company and lent him $12.1 million in October

2008 — just as the economy was reeling from the collapse of AIG and Lehman

Brothers.

"That's

outrageous," said Newsom, the former FDIC regulator. "He's purchasing

a property to mask a loss to the bank."

Accelerate

Bankruptcy and civil

court records show that at least 120 subcontractors have demanded that Bovino's

companies repay debts totaling more than $13 million.

These include drywall

contractors, plumbers, cabinet makers, pool maintenance companies, roofers,

engineers, architects, tile companies, masons and electricians in six states.

The majority have won judgments in their favor.

One of them, a general

contractor who paved roads and installed a sewer system at Bovino's 400-lot

development outside Wilmington, N.C., is out just over $1 million, according to

a judgment filed in New Hanover County.

James Bovino bet and lost on a 400-lot development in Brunswick County, N.C. It remains vacant.

James Bovino bet and lost on a 400-lot development in Brunswick County, N.C. It remains vacant.

Staff Photo / Michael Braga

"Instead of

telling us to stop when he knew he was in trouble, he told us to

accelerate," said Robert Thomson, a Wilmington general contractor.

"So we started putting in the really big-money stuff like sewers and

sidewalks."

That was classic

Bovino, according to two of his former managers.

As he began running out

of money, those managers say Bovino pressed subcontractors to hurry up and

finish their work so he could submit their invoices to the bank for payment.

But the managers said Bovino did not always use the bank funds to pay his

subcontractors as required by law.

Ronnie Lewallen, a

former executive at Bovino's housing development in the Atlanta suburbs, says

his predecessor "did everything in his power to get subs paid before Jimmy

ran out of money."

This angered Bovino and

his New Jersey executive team, and they quickly clamped down on the payments.

"When he

left," Lewallen said, "they put me in charge. But they didn't let me

control the money. I'm owed more than $100,000."

Though it was not

uncommon for subcontractors to go unpaid during the Great Recession, developers

understand that their long-term reputations are tied to their ability to pay

their bills.

Bovino does not seem to

have learned that lesson.

An associate of builder James Bovino bought these Bradenton town homes in March, but was hit with liens after failing to pay subcontractors.

An associate of builder James Bovino bought these Bradenton town homes in March, but was hit with liens after failing to pay subcontractors.

Staff Photo / Michael Braga

In March, he raised

$1.1 million from John Bivona, a New York attorney and owner of Felix

Investments. Manatee deeds show he used $950,000 to purchase a pair of town

homes and 11 vacant lots in Bradenton's Palma Sola area.

That left $150,000 to

fix up the town homes and get them ready for sale, says Hawkinberry, the

interior decorator who helped Bovino find the property.

But Hawkinberry said

Bovino diverted some of the money to a house he was building in New Jersey, so

there was not enough left to pay the bills.

In an email to

Hawkinberry, Bovino explained that he intended to repay the money as soon as he

sold the house in New Jersey. But a "greedy lawyer" took it to pay

one of Bovino's outstanding debts.

"That's what

happens when they find out our past history," Bovino wrote.

Bivona, who provided

the $1.1 million, told the Herald-Tribune he was not concerned about the

diversion of funds.

"He didn't do

anything he shouldn't have done," Bivona said. "If he needed to use

the funds for something else, that was fine with us."

Bivona — a licensed

attorney — also disputed owing anything to Hawkinberry.

"That's a B.S.

lien," he said. "That money is not owed her."

But Hawkinberry has

kept all of Bovino's emails and telephone messages, and they tell a different

story.

In them, Bovino

acknowledges he owes her money but says the only way she is going to get paid

is if she helps him get a $500,000 loan using the two town homes as collateral.

Hawkinberry

consequently referred Bivona and his wife to 1st Manatee Bank, Movement

Mortgage and C1 Bank. But they all declined to make the loans.

Throughout the process,

Bovino told Hawkinberry he intended to use some of the funds from the loans to

pay off debts owed to Iberia Bank, which acquired Century Bank's assets after

that Sarasota lender went under in November 2009.

"That's what I'm

concerned about now," he said in a voicemail message.

He also told Hawkinberry

not to say anything to Bivona.

But when it became

clear that Bovino was planning to take proceeds from the loan to pay off past

debts, Hawkinberry called Bivona.

That made Bovino angry.

"If you insist on

avoiding my directions, I will make sure your association with the company is

terminated!!!" Bovino wrote in an email message. "And let me say

this, if Mrs. Bivona's loan is denied and I find out that you had a

conversation with the bank that caused it to be denied you will be hearing from

our attorney very quickly."

Hawkinberry told Bivona

that if Bovino remained involved in the property, it would be difficult to sell

the units. She told him she had a buyer willing to purchase the property for

more than Bivona's company paid.

But Bivona told the Herald-Tribune

he was not interested in that offer.

"We're not going

to be frightened into doing that," he said.